What Is The Difference Between ESG and Sustainability?

A few years ago, one of our correspondents sat in a high-stakes meeting with a senior executive at one of the world’s largest oil companies. After a detailed presentation on sustainability—covering everything from net-zero targets to water usage—the executive leaned over and quietly asked, “We’ve been meeting ESG goals for years. Isn’t that the same thing as sustainability?”

When he told us that story later, it hit me just how often this confusion arises—not just in corporate boardrooms but also in classrooms, government discussions, and even among seasoned environmental professionals.

The thing is, ESG and sustainability are deeply connected—but they’re not the same.

That moment stuck with me because it perfectly captured why so many well-meaning companies get stuck making surface-level changes. They chase ESG scores, thinking that’s the finish line, when in reality, it’s just one tool in a much bigger toolkit.

In This Article

- Defining ESG and Sustainability

- The Historical and Practical Context

- Common Misconceptions

- Real-World Case Studies

- Practical Insights for Professionals and Businesses

- The Role of Greenwashing and Public Perception

- Actionable Advice

- Conclusion: It’s Not ESG or Sustainability — It’s Both, with Clarity

Defining ESG and Sustainability

What Is ESG?

ESG stands for Environmental, Social, and Governance—three areas used to assess how responsibly a company operates. ESG is primarily an investment framework. It helps banks, investors, and analysts gauge whether a business is managing risks and acting ethically in ways that could affect its long-term financial value.

Here’s a breakdown:

- Environmental: Think carbon emissions, climate risks, water usage, and energy efficiency.

- Social: This covers labour practices, supply chain ethics, community relations, and human rights.

- Governance: Includes board diversity, corporate transparency, executive compensation, and anti-corruption policies.

Why it matters: ESG gives investors a standardised way to compare companies. For example, in 2020, BlackRock—the world’s largest asset manager—made headlines by declaring it would start prioritising sustainability in its investment decisions. This wasn’t charity. BlackRock saw ESG as a smart financial move: Companies that manage environmental and social risks are more likely to succeed in the long term.

Key Takeaway: ESG is investment-driven. It’s about financial health in a world facing big challenges like climate change and social inequality.

What Is Sustainability?

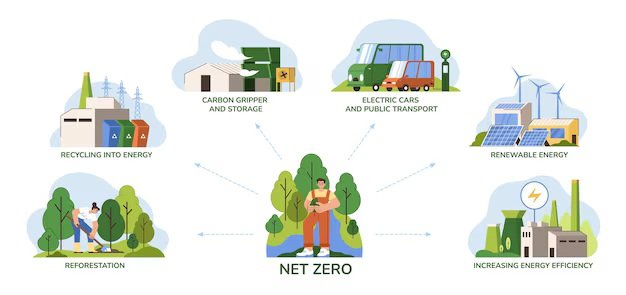

Sustainability is bigger than financial performance. It’s about building systems that work for people, the planet, and future generations.

It rests on three interconnected pillars:

- Environmental sustainability: Protecting ecosystems, using resources wisely, and reducing harm to the natural world.

- Social sustainability: Ensuring equity, inclusion, justice, and community wellbeing.

- Economic sustainability: Creating lasting value that doesn’t sacrifice people or the planet.

Unlike ESG, which often focuses on metrics and reporting, sustainability is mission-driven. It asks: “Are we building a future that’s actually livable?”

Here’s a real-world example: Take M-KOPA, a solar energy company operating in East Africa. While it might not rank highly on traditional ESG reporting frameworks due to its focus on local impact over investor metrics, its business model exemplifies sustainability in action. M-KOPA provides pay-as-you-go solar systems to off-grid communities, reducing reliance on diesel and kerosene. It also creates local employment, particularly among women, and improves economic mobility by enabling households to power small businesses and access digital services.

As McKinsey explains, ESG is primarily a measurement and reporting framework, while sustainability is a broader, long-term strategy that should be integrated into the core of how organizations create value and compete (McKinsey, 2024).

The Historical and Practical Context

The Rise of ESG: From Concept to Controversy

The term “ESG” was first introduced in the 2004 UN Global Compact report titled “Who Cares Wins.” It was envisioned as a framework to integrate environmental, social, and governance factors into financial analysis, aiming to promote responsible investment practices. Over the years, ESG has evolved from a niche concept to a central component of global finance.

By early 2024, ESG-related assets under management in the U.S. reached $6.5 trillion, accounting for 12% of all professionally managed assets. However, the ESG landscape has faced challenges. In the first half of 2024, U.S. ESG funds experienced net outflows exceeding $13 billion, following a $9 billion outflow in 2023. This trend reflects growing scepticism and political pushback against ESG investing, leading some companies to downplay their ESG commitments—a phenomenon known as “greenhushing”.

Despite these challenges, ESG remains a significant force in the investment world. A 2024 report by the US SIF Foundation highlighted climate action as the top priority for sustainable investing, emphasising the continued relevance of ESG considerations in addressing global environmental challenges.

The Evolution of Sustainability: A Broader Vision

Sustainability, as a concept, gained prominence with the 1987 Brundtland Commission report, which defined sustainable development as meeting “the needs of the present without compromising the ability of future generations to meet their own needs.” This holistic approach encompasses environmental preservation, social equity, and economic viability.

In recent years, sustainability has become a central focus for businesses and governments worldwide. The World Business Council for Sustainable Development (WBCSD) identified key trends for 2024, including increased emphasis on climate resilience, circular economy practices, and transparent reporting. Moreover, the World Economic Forum noted that the number of executives understanding the business case for sustainability tripled between 2022 and 2023, indicating a growing recognition of sustainability’s strategic importance.

However, 2024 also presented challenges. Harvard Business Review described the year as particularly difficult for corporate sustainability efforts, citing political turmoil and economic uncertainties as significant obstacles. Despite these hurdles, the commitment to sustainability continues to grow, driven by increasing awareness and the pressing need to address global environmental and social issues.

Expert Insight

George Serafeim, professor at Harvard Business School and ESG expert, often differentiates ESG as:

“A toolset and data framework to understand and drive sustainable performance.”

A Practical Comparison Table

| Dimension | ESG | Sustainability |

|---|---|---|

| Origin | Financial investing | Environmental & social movements |

| Goal | Risk mitigation & financial returns | Intergenerational equity & health |

| Focus | Metrics, ratings, disclosures | Mission, values, long-term systems |

| Audience | Investors, regulators | Society, policymakers, communities |

Learn More: International Environmental Regulations

Common Misconceptions

Misconception 1: ESG Is Just a New Name for Sustainability

It’s easy to think that ESG is simply a rebranded version of sustainability. Where ESG and sustainability diverge most clearly is in their scope and accountability. ESG focuses on standardised data and disclosures — carbon emissions, board diversity, and labour practices — to inform investors and stakeholders. It’s about what can be quantified and benchmarked. Sustainability, in contrast, doesn’t always rely on metrics. It often drives a company’s mission, shaping decisions that may not immediately boost shareholder returns but are intended to preserve ecosystems, support communities, and promote equity over the long haul.

Confusion often arises because ESG metrics can be used to assess a company’s sustainability practices. However, a high ESG score doesn’t necessarily mean a company is sustainable in the broader sense. For instance, a company might excel in governance practices but still have a significant environmental footprint. This distinction is crucial for investors and stakeholders who aim to support genuinely sustainable businesses.

Misconception 2: High ESG Scores Guarantee Sustainability

A common belief is that a company with a high ESG score is inherently sustainable. However, ESG ratings often focus on how well a company manages specific risks and disclosures rather than the actual impact of its operations on the environment and society.

For example, some mining companies may receive high ESG scores due to robust governance structures and transparent reporting. Yet, these same companies might be involved in activities that cause environmental degradation or social unrest. A report by RepRisk highlighted a 70% increase in greenwashing incidents among financial firms in 2023, emphasising the gap between ESG scores and real-world sustainability practices.

Misconception 3: ESG Is Only for Large Corporations

There’s a perception that ESG frameworks are only applicable to large multinational corporations. In reality, ESG principles are relevant to businesses of all sizes. Small and medium-sized enterprises (SMEs) play a vital role in the global economy, and their sustainability practices have significant local and global impacts.

Take Too Good To Go, a European SME that operates a food waste reduction app. Though not a multinational giant, the company has integrated ESG principles into its core business model. It addresses the environmental issue of food waste, fosters social impact by partnering with local businesses and communities, and upholds governance standards through transparency and ethical data use. Investors and impact funds have backed Too Good To Go because of its measurable ESG contributions, demonstrating how even smaller firms can benefit from ESG-aligned strategies.

Real-World Case Studies

1. Patagonia – A Sustainability-Driven Brand

Patagonia has long been recognised for its commitment to environmental and social responsibility. In 2024, the company took significant steps to enhance its sustainability initiatives. Partnering with Eastman, Patagonia recycled 8,000 pounds of pre-and post-consumer clothing waste using molecular recycling technology, converting unusable apparel into new fibres. Additionally, Patagonia joined the Pack4Good initiative, committing to sustainable packaging solutions that avoid the destruction of ancient and endangered forests. These efforts show Patagonia’s holistic approach to sustainability, focusing on both product lifecycle and supply chain practices.

2. Tesla – High ESG Ratings but Questionable Sustainability

Tesla’s mission to accelerate the world’s transition to sustainable energy has earned it high ESG ratings, particularly for its innovations in electric vehicles. However, the company has faced criticism for various social and governance issues. In 2022, Tesla was removed from the S&P 500 ESG Index due to concerns over racial discrimination claims and a lack of detailed disclosures related to its low-carbon strategy. Furthermore, Tesla’s Fremont factory has been cited for multiple air pollution violations, raising questions about its environmental compliance. These challenges highlight the complexities of aligning ESG ratings with comprehensive sustainability practices.

3. Unilever – Bridging ESG and Sustainability

Building on its 2010 Sustainable Living Plan, the company has updated its Climate Transition Action Plan in 2024, committing to net-zero emissions by 2039 and setting new science-based targets. This includes a €150 million investment in manufacturing decarbonization and €1 billion in climate, nature, and waste initiatives by 2030. Unilever also targets a 42% reduction in Scope 3 emissions from 2021 levels, addressing emissions across its entire value chain. In Nigeria, the company achieved plastic neutrality in 2024 by recovering more plastic than it sold, creating livelihoods through a partnership with Wecyclers. These initiatives demonstrate Unilever’s commitment to aligning ESG reporting with long-term sustainability objectives, creating value for both shareholders and society.

Practical Insights for Professionals and Businesses

1. For Investors: Look Beyond ESG Scores

ESG ratings from agencies like MSCI and Sustainalytics offer a starting point but often lack consistency and transparency. Discrepancies in ESG ratings are found to stem from variations in rating methodologies, data sources, and criteria weighting across different agencies. This inconsistency can lead to confusion, making it essential to delve deeper. A 2020 survey of institutional investors highlighted major concerns with ESG ratings, pointing to issues such as inconsistent and unreliable data, insufficient analyst expertise, and limited transparency in how ratings are determined. Therefore, investors should not rely solely on ESG ratings as a sole indicator but use them as a starting point to guide further diligence.

Consider conducting site visits and engaging with stakeholders to gain a comprehensive understanding of a company’s sustainability practices. This approach ensures a more accurate assessment of ESG risks and opportunities, aligning investment decisions with genuine sustainability performance.

For Entrepreneurs: Start with Purpose, Build with Transparency

Embedding sustainability into your business from the outset can attract investors and customers alike. A Morgan Stanley survey found that 85% of companies view sustainability as a value-creation opportunity. Even if formal ESG reporting feels out of reach, prioritise transparency in your operations. Clear communication about your sustainability efforts can build trust and open doors to funding.

For Policymakers: Enforce Meaningful Disclosures

Effective ESG disclosures should reflect actual sustainability outcomes, not just processes. Australia’s new climate-related financial disclosure regime, effective from January 2025, requires companies to report on climate risks and opportunities, integrating sustainability into financial reporting. Such regulations, coupled with third-party audits and stakeholder input, can help prevent greenwashing and ensure accountability.

Expert Insight:

“The corporate world must embrace the responsibility of sustainability, not as a box-ticking exercise but as an opportunity to redefine success. Embedding ESG principles into operations is about preparing for a future where profitability and purpose coexist to create shared value for businesses, society, and the environment.” — Paul Polman, Former CEO, Unilever.

The Role of Greenwashing and Public Perception

When ESG Claims Mislead

Greenwashing happens when companies exaggerate or misrepresent their ESG efforts to appear more sustainable than they truly are. This not only misleads investors but also erodes public trust.

A notable example is Deutsche Bank’s asset management arm, DWS. In 2022, German prosecutors fined DWS €25 million ($27 million) after investigations revealed that the firm had overstated its ESG credentials, misleading investors about the sustainability of its investment products.

The Consumer Perspective

Consumers increasingly prioritise sustainability in their purchasing decisions. According to a NielsenIQ study, 78% of U.S. consumers consider a sustainable lifestyle important. However, the prevalence of greenwashing and the confusion between ESG and genuine sustainability efforts can undermine consumer trust.

Learn More: What Are Green Loans?

Actionable Advice

For Companies: A Step-by-Step Guide

- Define Your Purpose: Start by articulating what sustainability means for your organisation. A clear mission statement aligns your team and communicates your commitment to stakeholders.

- Assess Your Impact: Evaluate your ESG risks and opportunities. Utilise frameworks like the Global Reporting Initiative (GRI) to identify areas for improvement.

- Engage Stakeholders: Involve voices from communities, employees, and supply chains. The Rainforest Alliance collaborates with major brands to implement income accelerators and regenerative practices, showcasing the power of stakeholder engagement.

- Report Transparently: Go beyond metrics; share the narrative behind your numbers. Transparency builds trust and demonstrates genuine commitment.

- Align Goals: Integrate ESG considerations into your core business strategy. Companies like Unilever have successfully aligned their brand portfolios with long-term sustainability goals.

For Individuals: Making Informed Choices

- Learn to Read ESG Reports Critically: Don’t just skim the headlines. Dive into the data, understand the methodologies, and assess the company’s genuine impact.

- Support Responsible Businesses: Choose to buy from companies with proven sustainability missions. Your purchasing power can drive positive change.

- Ask the Tough Questions: Inquire about the long-term implications of a company’s actions. I always ask businesses one question: “What are you doing today that will still make sense 50 years from now?” It reveals their true commitment.

Conclusion: It’s Not ESG or Sustainability — It’s Both, with Clarity

Understanding the difference between ESG and sustainability isn’t just semantics. It’s a crucial step toward building a fairer, greener world. ESG helps investors evaluate risks and returns, while sustainability guides humanity’s long-term survival. When they’re aligned, they’re powerful. When they’re confused, we all lose.

Let’s keep the conversation going because the planet, our communities, and our portfolios deserve better.